Dustin Vance blog posts

Housing Affordability Is A Challenge Right Now

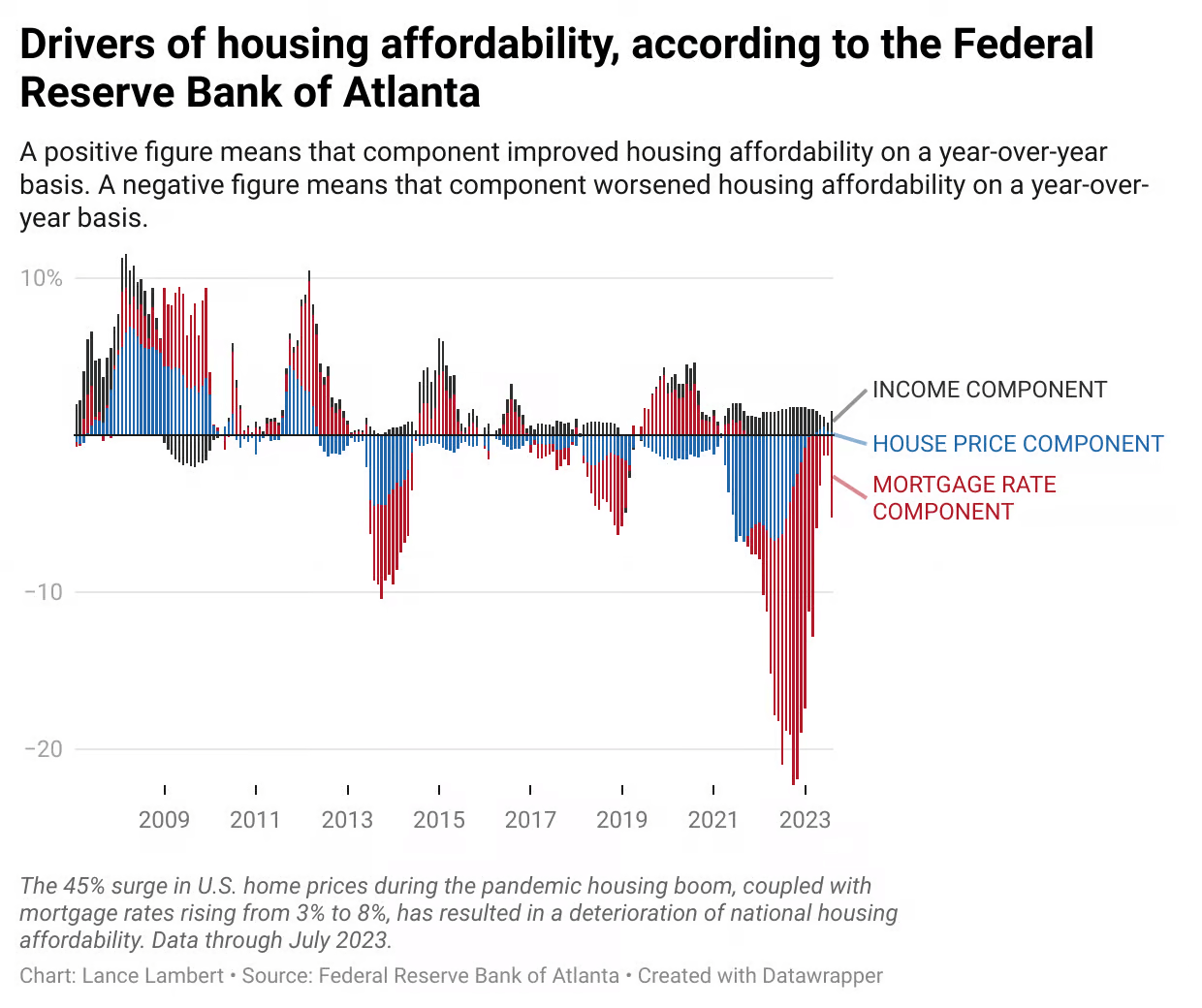

Let’s not dance around it: We’re amid a historic deterioration in housing affordability. The 44% surge in U.S. home prices since March 2020, coupled with mortgage rates rising from 3% to 8%, has translated into the fastest-ever deterioration in housing affordability.

Sure, by most measurements, the early ‘80s housing market—when mortgage rates got as high as 18% in 1981—was more unaffordable.

However, when it comes to the housing cycle, the pace of change is crucial. And right now you can’t blame buyers and industry professionals alike for feeling a little dizzy.

“Over the past month I have met with young buyer’s in typical jobs, like plant workers, police officers making the median income but unable to afford the median priced home in the Houston area. For the first time in my 28 year career it’s cheaper to rent and many are choosing that option. For those who are purchasing have more options and can be picky, negotiating on terms. Buyers are also picking homes with lower tax rates and cheaper insurance because every dollar counts,” Jeff Bulman, a real estate broker in League City, Texas (suburb of Houston).

In a note sent out on Tuesday, Morgan Stanley analysts confirmed we’re seeing the fastest-ever deterioration in housing affordability, and that “monthly payment on the median priced home up 27% year-over-year, +120% from mortgage rate lows ~2.5 years ago.”

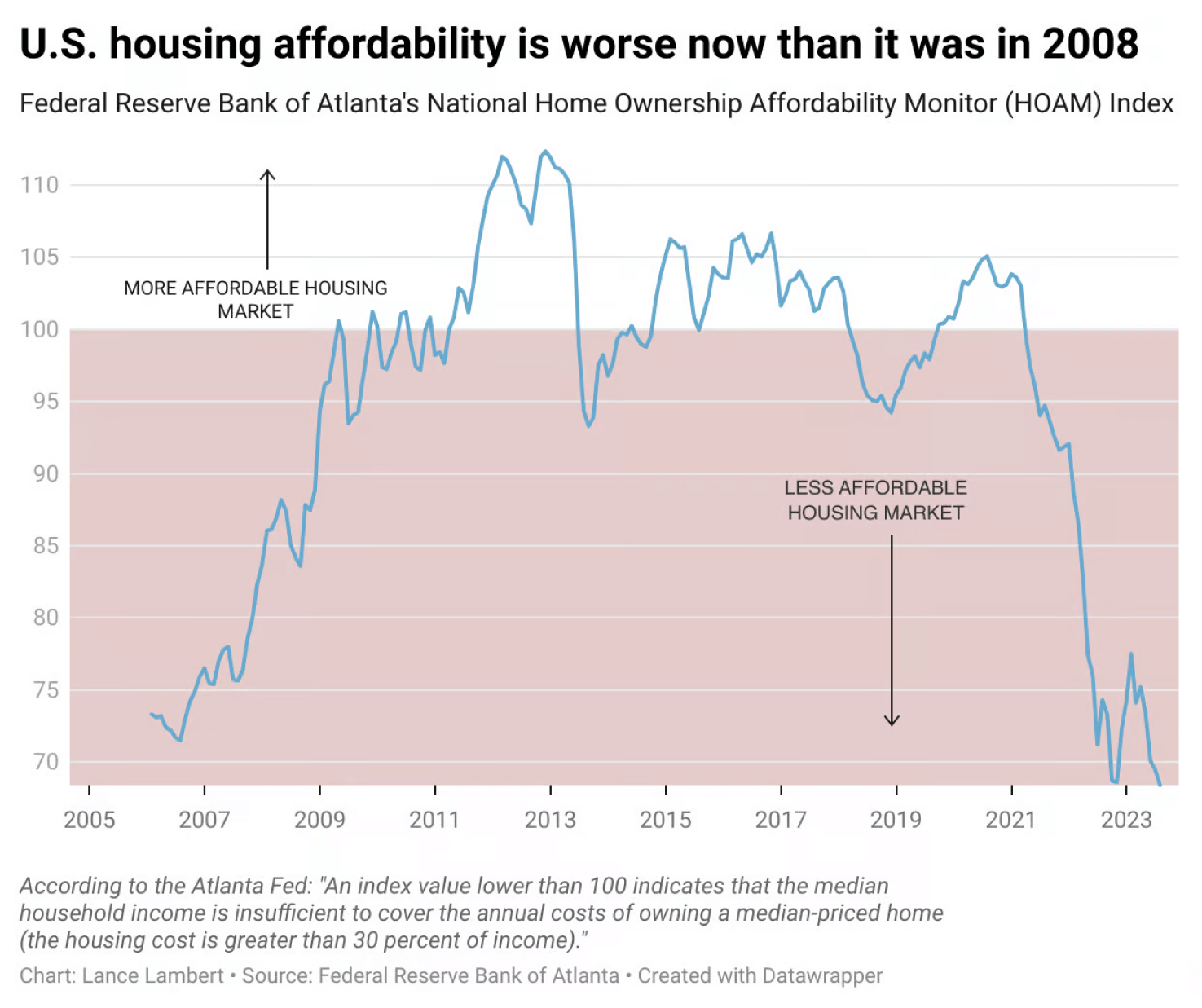

Taking into account mortgage rates, incomes, and house prices, July 2023 stood out as the least affordable month for U.S. housing this century, according to the Atlanta Fed’s Home Ownership Affordability Monitor.

With the recent surge in mortgage rates, the readings for August, September, and October are expected to be even worse than July.

In total, there are 3 levers that can improve housing affordability moving forward: rising incomes, declining home prices, or lower mortgage rates.

Among these 3 levers, mortgage rates have the most potential for short-term impact. Unlike home prices, which, historically speaking, tend to be “sticky”, mortgage rates are inherently volatile and could quickly decrease if, for example, the U.S. economy enters a recession.

Another potential pathway to improved affordability is if we enter a prolonged period during which increased home construction restrains house price growth, while incomes continue to rise. This, combined with lower rates, is how national affordability improved in the 1990s.

The last time housing affordability was this strained, it was restored after national house prices crashed by 27% from peak to trough between 2007 and 2012. Most housing economists I've spoken to don't expect a pullback of that magnitude. Unlike the years preceding the 2008 crash, the nation is not grappling with an excessive surplus of existing homes for sale. In fact, national housing inventory levels are near historic lows, with September 2023 having 47% fewer resale listings than in September 2019. Furthermore, the U.S. housing market in 2023 is not plagued by the risky mortgage products that contributed to the 2008 crisis.

Will national house prices fall in the future? Groups like CoreLogic, Fannie Mae, and Zillow don't foresee it happening—they think national house prices will tick higher in 2024. However, Moody's Analytics and Morgan Stanley still believe that a single-digit national house price decline could be possible in 2024.

“If home sales remain at these levels for an extended period of time, we become even more reliant on inventory staying at record lows to prevent home prices from falling. In our view, even a 5% growth in inventory next year would yield a 5% drop in [national] home prices by December 2024 if it came alongside zero increase in [U.S. home] sales,” Morgan Stanley wrote to investors on Tuesday.

The Future: Marrying Reality with Hope

The phrase “marry the house, date the rate” conveys a message of commitment and flexibility. But in light of the present situation, potential homebuyers and current homeowners alike should approach this saying with caution. While the prospect of refinancing at a lower rate in the future is alluring, it shouldn't be the cornerstone of a financial strategy.

Instead, individuals should be prepared for the long haul. When committing to a mortgage, one should be ready, both mentally and financially, to see it through its entirety at the agreed-upon rate. If a refinancing opportunity does present itself, it should be viewed as a bonus, not an expectation.

In Conclusion

The mortgage market’s recent trajectory underscores the importance of a balanced approach, one that combines optimism with realism. Predictions and forecasts, while valuable, should be taken with a grain of skepticism. Instead of being swayed by the ever-changing winds of market predictions, potential homebuyers should ground their decisions in both personal financial realities and broader market trends.

References:

https://www.resiclubanalytics.com/

Dustin Vance